This afternoon the UW Graduate Program in Taxation's class, "Tax Crimes: Investigations, Prosecutions, and Penalties," featured a panel discussion on prosecuting and defending a tax crime case. Prof. Nicole Chicoine generously invited others to visit the class. I took advantage of the opportunity and found the lively discussion very interesting.

The speakers included:

- Assistant U.S. Attorney Robert Westinghouse (senior litigation counsel in the U.S. Attorney's Office for the Western District of Washington)

- Defense Attorney Darrell Hallett, Chicoine & Hallett

- Defense Attorney Bob Chicoine, Chicoine & Hallett

- Defense Attorney Jim Frush, Cable, Langenbach, Kinerk & Bauer

Among them, these attorneys have over a hundred years of experience. Two of the attorneys now in private practice also worked for the government at some time -- one for the IRS and one as a special judge for the U.S. Tax Court. Quite a well-qualified panel!

A few observations:

- There are more layers of decision-making in tax prosecutions than in some other criminal prosecutions. An IRS special agent opens the file, investigates, and -- sometimes -- recommends prosecution. Then it all must be reviewed by the Department of Justice's Tax Division in DC. And then it goes to the local U.S. Attorney's office.

- Many of the cases turn on intent. Was the failure to file willful? Did the taxpayer intend to underreport income? (This differs from much other criminal practice where the key question is: Did this person do this deed?)

- Many defendants (and attorneys) face a "filing dilemma." Suppose the defendant is being investigated for failing to report the existence of offshore bank accounts. When the next April 15 comes around, should the taxpayer file and report the accounts? If so, then the information in the tax return could be used by investigators to turn up evidence about the past years. If not, then the fraudulent filing problem is compounded. (I suppose this sort of thing could come up in other contexts -- but not in a basic criminal case about a murder the defendant did or didn't commit at some point in the past.)

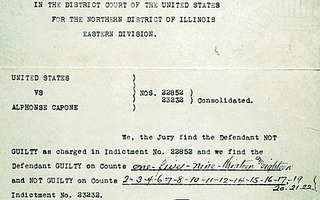

Filed in: tax, criminal-law, practice-of-law, UW, Chicoine, Frush, Hallett, Westinghouse, event, Capone

Image: Jury verdict in tax case against Al Capone. National Archives and Records Administration, http://www.archives.gov/exhibits/american_originals/capone.html

No comments:

Post a Comment